What's Next, Now: July 2025

This month, our crystal ball predicts a BNPL shakeup to personal finance, an existential crisis for SaaS, nuclear’s new era, and more.

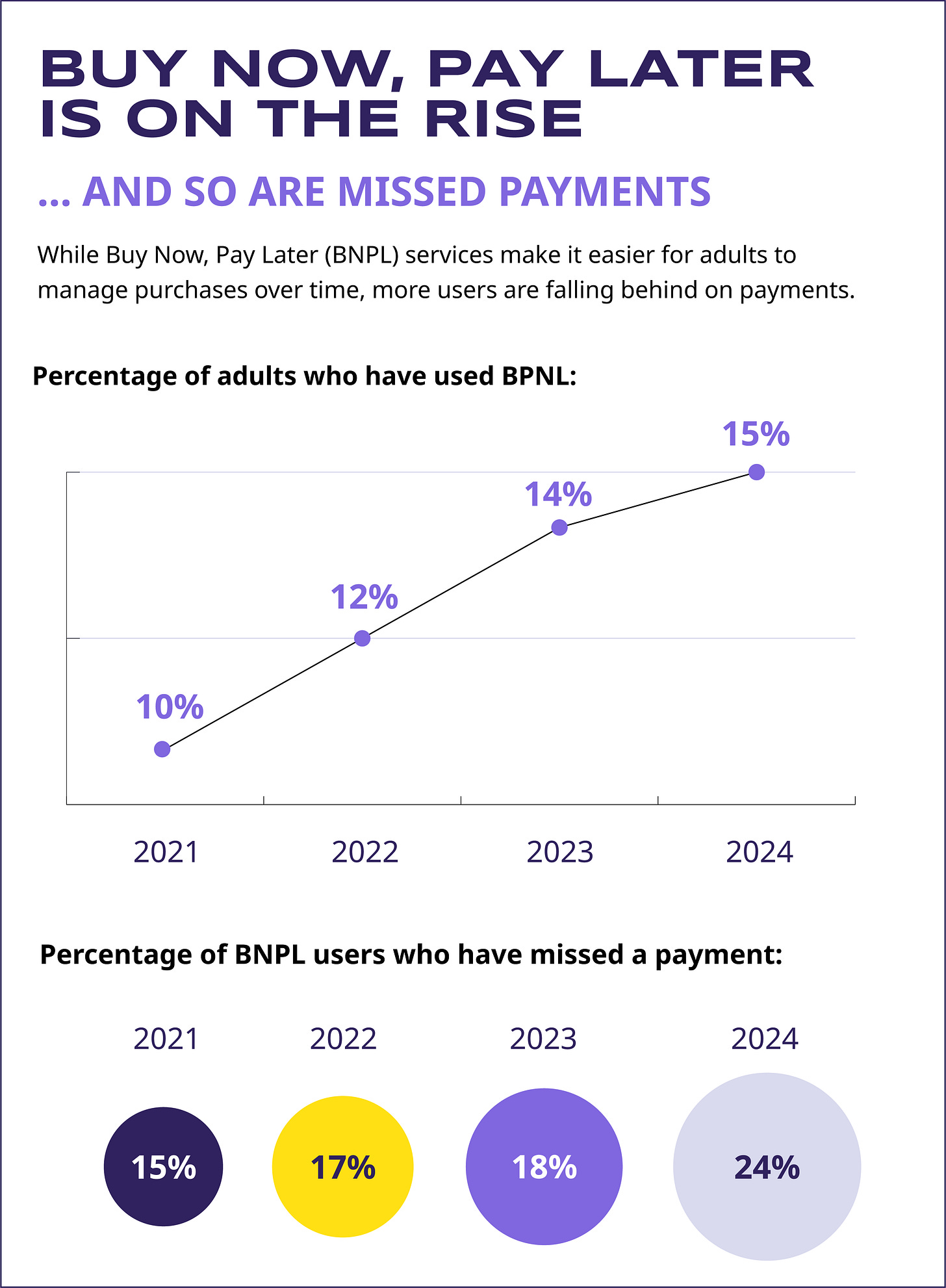

Not long ago, financing was reserved for big-ticket items like cars, major appliances, and homes. But with the rise of buy now, pay later (BNPL), consumers can break up payments on everything from DoorDash deliveries to everyday essentials like groceries and pet food.

And they are. At record levels.

In 2025, an estimated 91.5 million Americans will use BNPL, roughly a 6% increase from last year. Top reasons include wanting to spread out payments, convenience, and being the only way to afford a purchase. Essentially, BNPL enables a lifestyle consumers may not be able to afford otherwise. For example, 60% of attendees at this year’s Coachella used BNPL to finance their tickets.

But there's a tradeoff. FICO is now introducing two new credit scores that factor in BNPL data, giving lenders deeper visibility into consumers’ short-term borrowing behavior — including their late payments. So that concert ticket or grocery run? It could soon impact your credit score.

BNPL's rise coincides with a broader shift in how we think about money. Fewer people carry cash, and when they use cards instead, they spend 12–18% more on average. Money is becoming less tangible and easier to part with.

As debt becomes normalized for even the smallest buys, and physical money fades (the U.S. will stop producing the penny next year), brands need to adapt to changing consumer expectations and behaviors. Offering BNPL at checkout can increase purchases — but it comes with responsibility.

More than half of Gen Z (52%) say debt is on their minds most or all of the time. And according to Money Talks 2025: The Youth Tax report, about 60% say brands have an important part to play in educating young people around debt and credit scores, and the same amount feel brands don’t do enough to help them understand the risks around credit. As younger shoppers juggle financial anxiety with the desire for flexibility, brands that offer transparency around finances will stand out. The opportunity isn’t just to drive sales, but to build lasting loyalty by meeting consumers where they are financially and emotionally.

IT departments have a more pressing issue than you getting locked out of your computer for the second time this week. Recent data shows 60% of organizations are adding new software and tools at least once a month. One in five do it once a week. These rapid downloads are culminating in a growing problem: SaaS sprawl.

Besides being a headache of another password to forget, having too many software tools can create complexity rather than streamline operations — the exact opposite of what SaaS is meant to achieve. From troubles with data duplication, workflow delays, manual processes, and disconnect between systems, this net-loss of productivity is wreaking havoc both for customers and SaaS providers.

If SaaS overload is such a headache, why do companies keep adding? One issue is the SaaS model itself. Software is meant to solve a problem, but every department or employee downloading a program has something different to solve. A bit of stubbornness might also contribute. Users like the tools they like — for instance, while Microsoft’s AI tool Copilot may offer better integrations than a third-party tool, everyone just wants to use ChatGPT.

The majority of IT leaders consider solving software sprawl a core part of their job description. But it’s more than just an IT issue. You know how they say all companies are tech companies? Well, all jobs are tech jobs now, too. Take a CMO for example. The ideal candidate is now someone with as much experience in marketing creativity as they do with software management, cybersecurity best practices, and AI integration.

On the other side, SaaS providers also need to address sprawl or risk losing out. Last fall, we discussed how AI could pose an existential threat to the whole SaaS empire, offering the potential to consolidate workflows as well as democratize the creation of custom in-house solutions. The next level of SaaS innovation is needed to avoid obsolescence.

For decades, nuclear power in the U.S. has been politically controversial and economically risky. High upfront costs, complex regulations, and public resistance meant that very few new plants were built after the early 2000s. But this may be starting to change.

Nuclear energy is experiencing a resurgence in the country and around the world as governments and utilities revisit it as a viable path to meet rising energy demands and climate goals.

In June, New York announced it will build one of the first new nuclear power plants in a generation. The state’s public utility, the New York Power Authority, has been tasked with developing at least one gigawatt of nuclear capacity, which is enough to power nearly one million homes. Additionally, the Tennessee Valley Authority became the first U.S. utility to submit a permit application to create its own reactor, known as a small modular reactor (SMR). The tech could be done by the early 2030s, with a much smaller footprint, passive safety systems, and faster build times compared to traditional plants.

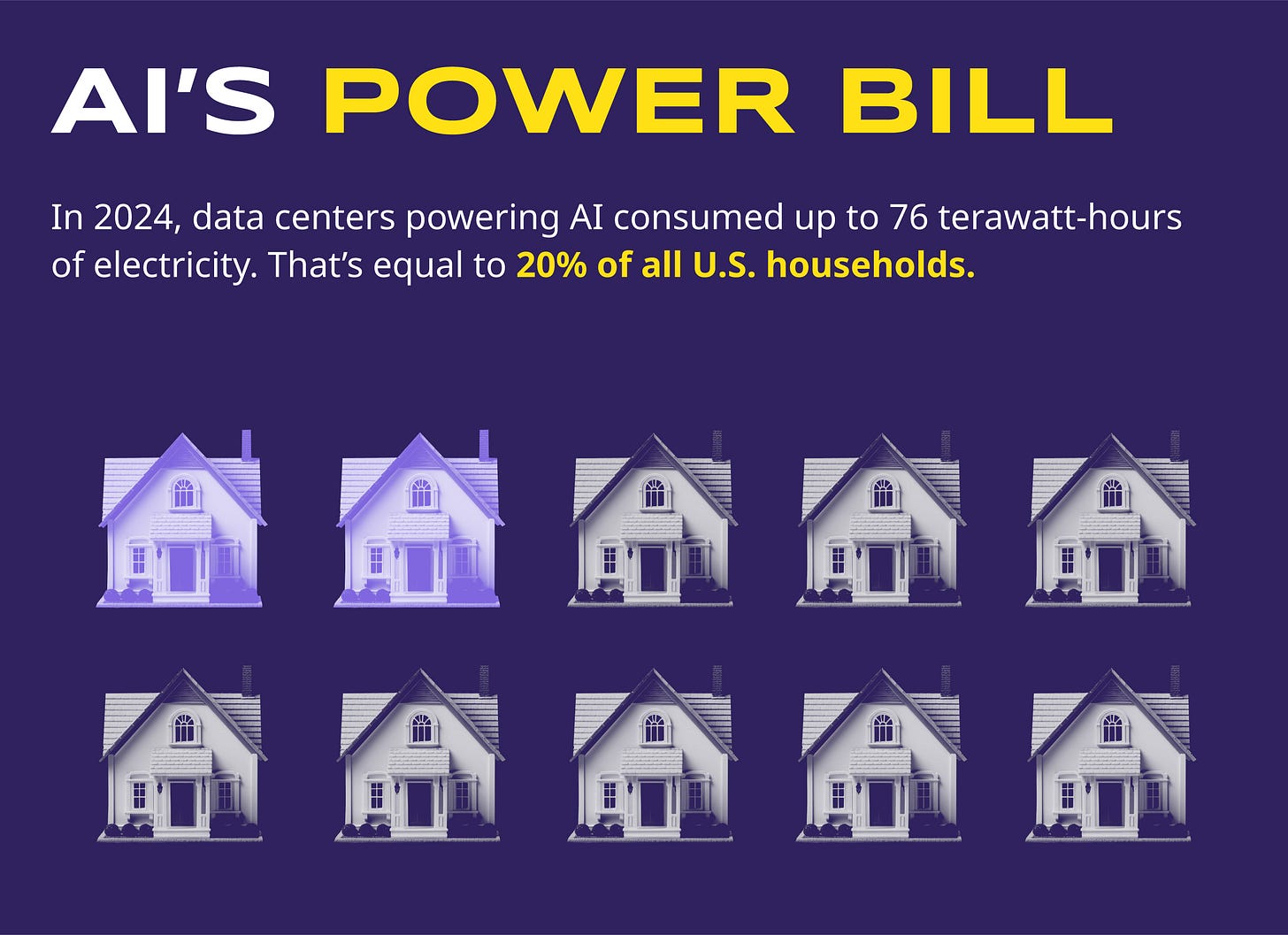

What’s driving the renewed interest? In (a large) part, the AI boom. Data centers — especially those powering generative AI — are soaking up electricity at a record pace. Last summer, we discussed how data centers could consume up to 9% of all U.S. electricity use by 2030. Utilities and governments are looking for clean, accessible power that can meet 24/7 demand. Enter nuclear power plants as a solution.

Federal policy is catching up to demand. The U.S.’s ADVANCE Act aims to streamline the permitting process, reduce financing friction, and accelerate deployment of advanced reactors. Globally, countries like Poland, Czechia and Romania are moving quickly to adopt similar SMR technologies, creating the potential for a competitive clean energy race. Major opportunities are ahead for organizations in the space.

For brands developing and deploying AI systems, you are now unavoidably a stakeholder in the national and global energy conversation. With your growing influence over grid demand and climate strategy, it’s important to be prepared with a clear message and ready to use your voice, if and when you choose to join in.

Since the first time a luxury cruise left the shores in 1900, these ships have evolved into floating playgrounds — offering travelers a chance to indulge in entertainment, dining, and leisure, all while drifting across open water. Now, other luxury hospitality giants are climbing aboard. In 2026, Hilton’s high-end Waldorf Astoria brand will debut its first cruise experience, setting sail down the Nile River. The ship promises “timeless and enriching” travel paired with Waldorf’s signature service, extending the brand’s luxury footprint beyond dry land.

This move is more strategic than surprising. The cruise industry has been on a steep rebound since the pandemic, with 19 million Americans expected to set sail in 2025. Carnival just posted record-breaking Q2 results, proving that demand is strong through the first half of 2025 — and it’s being driven by more than just families and retirees.

Younger generations are showing up in force. According to Royal Caribbean Group CEO Jason Liberty, half of their customers are Millennials or younger. Cruise lines like Virgin Voyages are winning over these generations with no-kids policies, sleek interiors, and built-in Instagram-friendly spaces. As AAA Travel’s Stacey Barder puts it, cruises “offer something for everyone, no matter their age. And because most of the vacation is already paid for, travelers can focus on enjoying themselves and making lifelong memories with loved ones.”

Cruise lines’ appeal offers broader lessons for brands across industries. Gen Z and Millennial travelers are choosing memory-making moments over material things, gravitating toward curated, visually rich, and socially shareable experiences. In fact, 73% of Gen Z say they’d rather have a better quality of life than extra money in the bank — a mindset that favors travel and experience over material gain. So whether it’s a vacation, a pop-up, or a digital activation, experiences that feel personal and post-worthy are going to drive engagement.

You asked (relentlessly, on social media). They answered: The Snack Wrap is back.

McDonald’s Snack Wrap earned its fame as a well-loved menu item and for the never-ending plea from social media users to please bring it back. After nine years off the menu, it’s the perfect time to finally announce its return. Today, the need for comfort in chaos and a growing hunger for a good deal are converging to rekindle the chain restaurant heyday.

Younger diners are an increasingly important customer base for these staples, and they’re driving growth. Chili’s is the prime example, riding the massive social media wave of the Triple Dipper and focusing on quality over quantity in its menu to bring in record customers. Red Lobster recently exited bankruptcy under a new 36-year-old CEO, with fans flocking in after his introduction of a seafood boil. And after years of slowing growth, Chipotle’s CEO now says they’re opening a new location every 24 hours.

Of course, not every chain restaurant glow up has hit the mark. Cracker Barrel tried a more modern look for its stores, but diners say the move cheapened its charm.

Better menus, viral promotions, and the power of food nostalgia might be contributing to this surge, but cost is still in the driver’s seat. To reduce food spending, consumers are also cooking at home more often and shopping at bargain grocers like Dollar General.

We’ve got a few restaurants on our radar for the next comeback: Applebee’s, Texas Roadhouse, IHOP (as long as they pick a better marketing strategy than “IHOB”), or maybe a themed favorite like the Hard Rock or Rainforest Café.

One hurdle these chains will have to contend with is the other major food movement currently sweeping the shelves: MAHA-style wellness and pushback against processed foods. Can McDonald’s make its snack wrap without seed oils? Brands once forced to pick a lane are now navigating a middle road full of contradictions. If a brand can successfully solve this puzzle, they’ll win the race.

Staying home, or going out alone: The loner spender is a new driving economic force.

Have you seen Google’s new AI Mode tab? News sites and businesses aren’t so happy about it, as the rise of AI continues to devastate search-driven web traffic.

We know Gen Z is making blue collar cool again. Where else will they innovate in these traditional trades?

Want to hear more? Explore the Tier One blog, TOP TALK, for the latest digital marketing trends, tips, and insights.

Copyright © 2025 Tier One Partners is a women-owned full-service PR, content, and digital marketing agency. We work with innovators in B2B and B2C technology, digital healthcare, financial services, energy tech, and manufacturing to develop award-winning creative, data-driven strategies that propel them to industry leader status. From day one, we’re committed to earning our clients’ trust, sharing their vision, and embedding their purpose into everything we do. To learn more, visit wearetierone.com.